Is the Shepperton Property Market a Buyers’ or Sellers’ Market?

Are you a Shepperton homeowner considering a move in the next six to twelve months? Perhaps you're a buy-to-let landlord weighing up whether to expand or streamline your portfolio? Or maybe you’re a first-time buyer wondering if now is the right moment to take the plunge?

Whatever your position, knowing whether the Shepperton market is currently favouring buyers or sellers will help you make informed decisions.

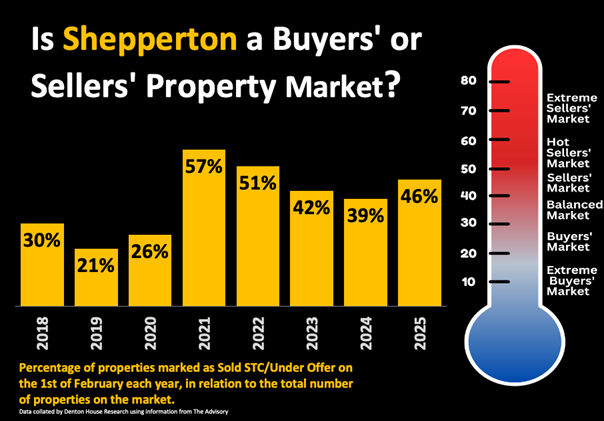

For those who regularly follow my Shepperton property market updates, you'll know that the best way to measure whether we are in a buyers', balanced, or sellers' market is to analyse the proportion of properties marked as "Sold STC" or "Under Offer" compared to the total number of properties on the market.

For instance, if there are 300 Shepperton properties on the market, of which 100 properties are sold stc/under offer and 200 available properties, 100 as a percentage of 300, equates to 33.3%.

This percentage figure acts as a barometer for market conditions and can be analysed using this table:

· Extreme Buyers' Market (0%-20%)

· Buyers' Market (21%-29%)

· Balanced Market (30%-40%)

· Sellers' Market (41%-49%)

· Hot Sellers' Market (50%-59%)

· Extreme Sellers' Market (60%+)

How Does Shepperton Compare?

Looking at historical data from the website, The Advisory, which has tracked this metric for years, we can observe some key trends for each February. (For this exercise, Shepperton is TW17).

· In the years before the pandemic (2018/19/20), Shepperton’s market hovered between 21% to 30% (remember the pandemic started in March 2020).

· Demand rebounded post pandemic sharply in the summer of 2020, and continued into 2021 and 2022. In February 2021, the percentage had risen to 57% and in February 2022, it was at 51%.

· However, with the fallout of the Liz Truss and Kwasi Kwarteng budget in late 2022, by the time we got to February 2023, it had settled down to 42%. By February 2024, the figure had softened slightly to 39%.

· Now, in February 2025, we see the figure sitting at 46%.

Implications for the Shepperton Property Market in 2025

For sellers: We are now in a Shepperton property market where patience and strategy are essential. Buyers have more choice (as I have spoken about many times recently in my Shepperton property market blog posts), meaning sellers must focus on pricing realistically and ensuring their home stands out. Overpricing will lead to extended time on the market (which seriously cuts down your chances of both selling and eventually getting your sale to exchange and completion).

That being said, well-presented and appropriately priced Shepperton homes continue to attract solid interest. With mortgage rates stabilising, there is confidence among buyers—but they are taking their time to make decisions. A proactive marketing approach, including virtual tours, strong photography, and digital exposure, will be key to securing a sale in a reasonable timeframe.

For Shepperton buyers: Those in the market for a Shepperton property in 2025 will find they have a little more breathing space compared to the frenzied activity of 2021/22. While desirable properties still attract competition, there are opportunities to negotiate on price or secure favourable terms, particularly on homes that have been on the market for a while.

I cannot stress the importance for any buyer to get your mortgage pre-approved before you start offering, as it seriously strengthens your position when making an offer. Also, consider broadening your search slightly—sometimes the best value can be found just outside the most sought-after areas.

With a new Government settling in and wider economic factors at play, there is much to consider for those looking to buy or sell in Shepperton this year. The property market remains resilient, but expectations need to be adjusted to this more stable, ‘normal’ environment.

Are you planning to move in 2025? What are your thoughts on how the Shepperton property market will evolve? I’d love to hear your insights.