Get in touch with us

Navigating the property market can be challenging, but our 'Heads Up' system offers a smarter, more efficient way to find your next home or connect with the right buyer. Let's explore how this innovative approach benefits everyone involved.

Managing a probate property while coping with loss can feel overwhelming. This gentle guide explains the key steps, realistic timescales for 2026, and what to expect when selling a home as part of an estate.

When you look back at the average rents achieved in Shepperton over the last five years, from 2021 through to 2025, a clear pattern emerges. Shepperton saw extraordinary growth in rents as the market experienced a period of exceptional pressure post pandemic, yet in the last 12 months, is now settling into something far more measured.

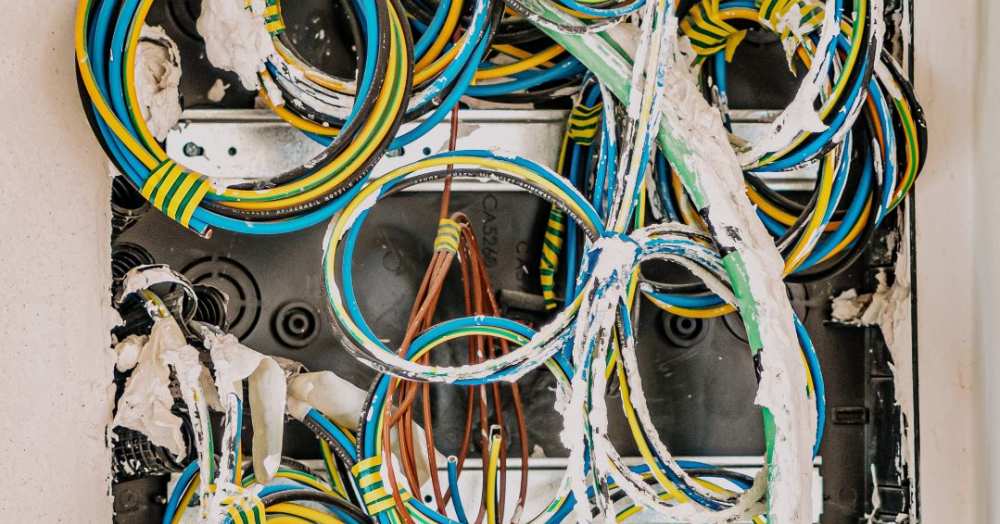

With ongoing reforms and rising compliance demands across the UK, managing a rental property alone is becoming increasingly complex. Here’s why professional management now matters more than ever.