A Shepperton landlord recently asked me what the difference was between the brand new property she was considering purchasing compared to a similar second-hand home in the same location. It's a common question, and many homeowners and landlords in Shepperton have likely pondered it.

So, I decided to dig into the data to uncover the truth behind the 'new build premium'—and the latest statistics offer some fascinating insights.

Why Do New Builds Cost More?

At first glance, the price difference between a new build home and an existing property might seem to be down to personal preference. Some buyers (and tenants) prefer a new home's fresh, modern feel, while others favour the character and reliability of a property that has stood the test of time. But is there more to it than taste?

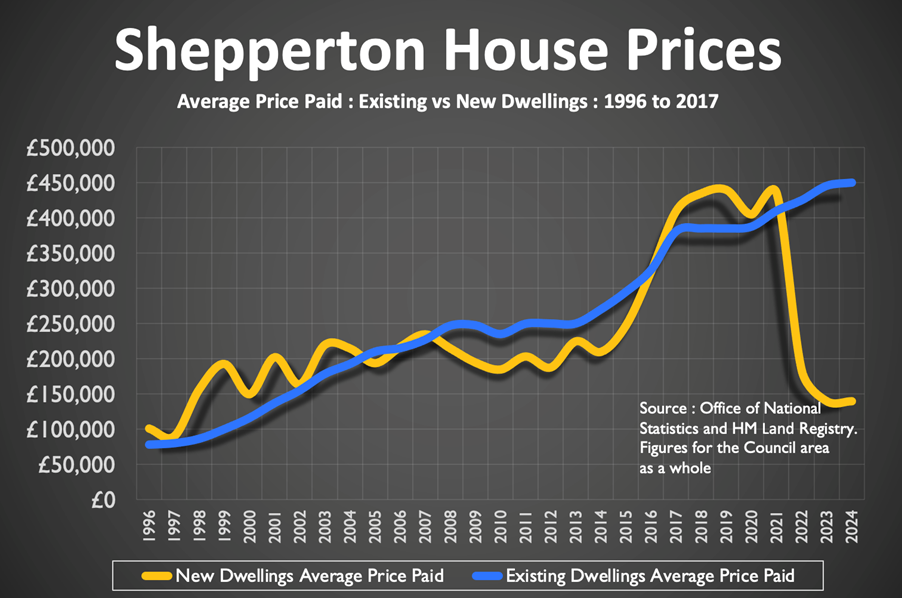

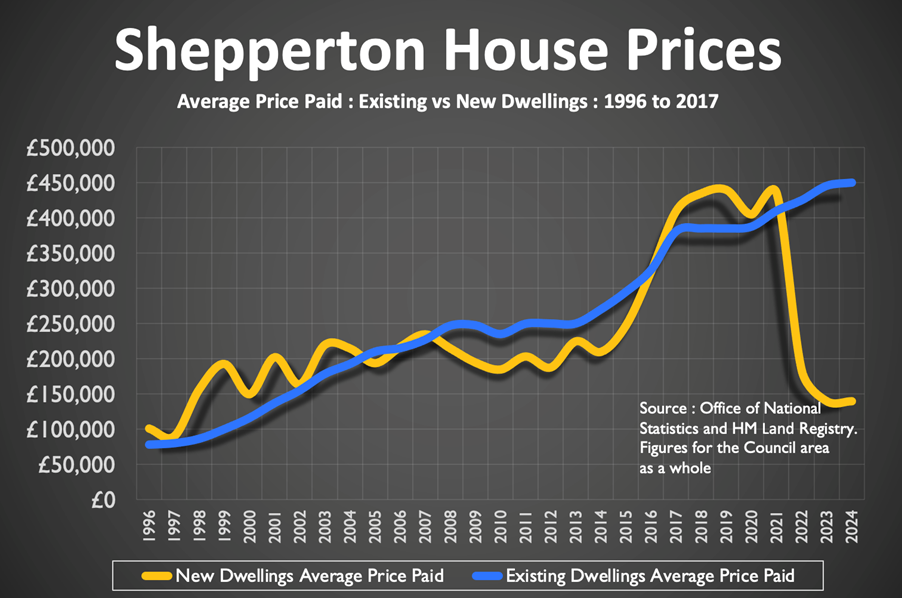

Looking at the average price paid for existing (second-hand) homes versus new build properties in Shepperton and the wider Spelthorne Borough since 1996, a clear trend emerges: new build homes command a significant premium.

· Between 1996 and 2008, the average newly built home sold for £25,516 more than an existing Shepperton home.

· Yet, between 2008 and 2013, the average newly built home sold for £19,278 less than an existing Shepperton home.

· Since 2013, the average newly built home has sold for £67,848 less than an existing Shepperton home.

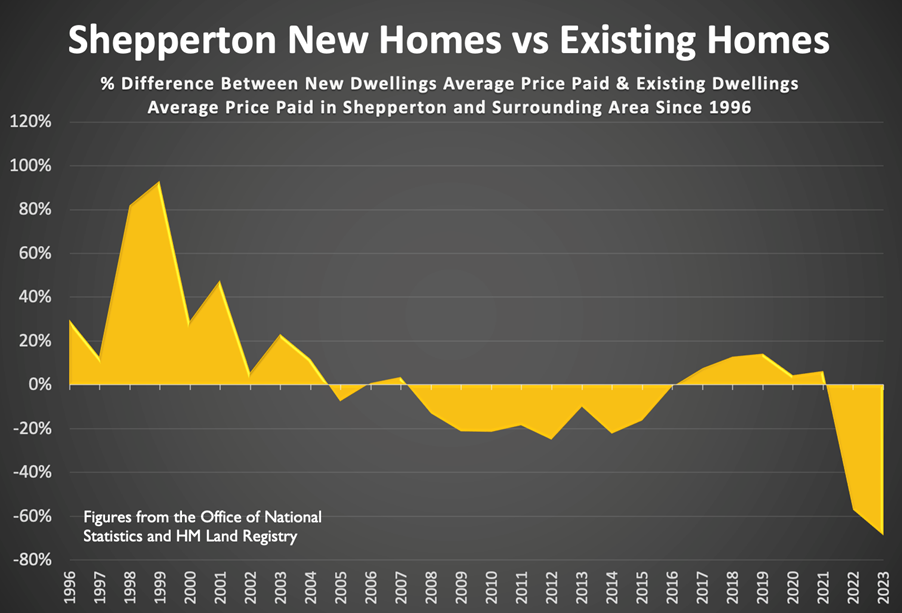

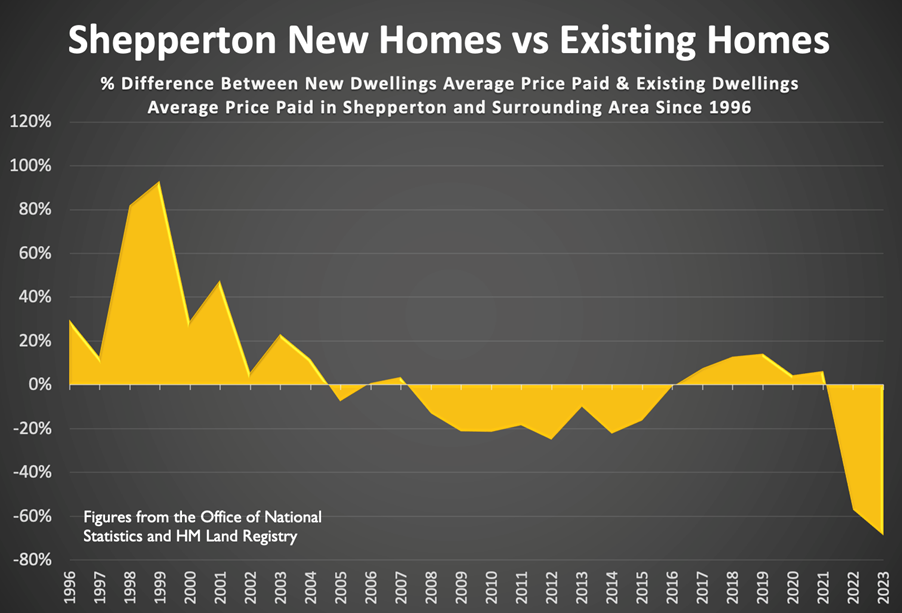

Over the past 29 years, the average ‘new build premium’—the additional amount buyers pay for a newly built home compared to a second-hand one—has been 8.7%. However, if we look at the last 10 years, that is 16.5% less, bucking the national trend.

The ‘new build premium’ refers to the additional price buyers pay for a newly constructed home compared to a similar second-hand property. Factors such as modern design, energy efficiency, and developer incentives contribute to this price gap. However, the premium fluctuates with market conditions—rising in a strong market when demand is high and shrinking in tougher times when buyers have more negotiating power.

Understanding this trend can help buyers and investors make more informed decisions about when and what to buy.

The Numbers Behind the Premium

Using the latest data up to the end of 2023, the difference in the average price paid for a new home versus the average price paid for an existing home continues to highlight a consistent premium. Overall, it’s my experience that the premium for new detached and semi-detached homes is in the order of 10% to 20%, while apartments can be much higher than that. As always, there are exceptions to the rule.

Why Do Buyers Pay More for a New Build?

Many buyers are willing to pay a premium for a new build, despite the perception that they are overpriced. One key reason is personalisation—new homes can be tailored to suit individual needs, lifestyles, and furniture choices. Additionally, they require less maintenance than older properties and often come with a builder’s guarantee, providing peace of mind against unexpected issues. With no need for immediate refurbishment or repainting, moving in is a hassle-free experience.

Another major factor is energy efficiency. Older homes tend to have poor insulation and higher running costs, whereas modern builds are designed to be more energy-efficient, helping to reduce household bills. In recent years, as energy costs have risen, efficiency has become a top priority for many buyers, alongside location and lifestyle.

The Property Market Factor: Boom vs. Bust

One of the most revealing insights from the data is how the ‘new build premium’ fluctuates with the property market cycle:

• In a strong, buoyant market, the premium tends to increase as buyers compete for new stock, and developers’ prices increase accordingly.

• The premium shrinks in a slower, more challenging market, offering better value for those looking to buy new.

• Nationally, the premium was higher before the global financial crash (2008/9) compared to afterwards.

This means that if budget is the primary concern, timing is crucial. Purchasing a newly built home in a softer market could be a smarter financial move than in a property boom.

The Reality of Comparing Like for Like Homes

It’s important to acknowledge that comparing new build and second-hand Shepperton homes isn't always straightforward. Unlike cars, where a brand-new vehicle and a low-mileage second-hand version can be directly compared, housing has more variables at play—location, build quality, developer reputation, and even incentives like part exchange or stamp duty contributions.

By their very nature, the type of Shepperton homes that have been built as brand new homes in one year could be completely different from the existing Shepperton homes that are being sold. Also, for every new home sold in a year, the number of existing homes is in the region of five to seven depending on the location.

Therefore, a perfect like for like comparison would require identical properties, side by side, in the same condition—a scenario that rarely exists. This complexity means that while the premium is a useful benchmark, it should be taken with a pinch of salt and your individual circumstances always play a role.

Final Thoughts

Should you pay the premium for a new build? It depends on your priorities. The extra cost might be worth it if you value a pristine Shepperton home with the latest design and efficiency standards. However, if maximising value is your goal, buying secondhand—or timing your purchase of a brand new home in a weaker market—could be the better move.

What are your thoughts? Have you paid a premium for a new build home in Shepperton, or do you prefer the character of a second-hand property? I’d love to hear your experiences in the comments.